Concentrated Liquidity

A feature that allows users to provide liquidity in TAO and ALPHA tokens to specific price ranges in subnet pools, earning fees from trades.

Concentrated Liquidity allows users to provide TAO and ALPHA tokens within specific price ranges instead of across all possible prices. Unlike regular staking and unstaking, this system lets users earn trading fees when others trade within their specified price ranges.

When users choose a specific price range, their tokens only work within that range. The narrower the range, the higher the potential fee collection per unit of tokens, but with increased risk of the price moving outside the range.

UNISWAP V3 IMPLEMENTATION

Concentrated Liquidity refers to the Uniswap V3 system implemented in Bittensor. Subnet owners must enable this feature before users can participate.

The protocol continues to provide liquidity across all possible prices as before. Concentrated liquidity adds the ability for individual users to provide additional liquidity within specific price ranges of their choosing.

This feature converts existing protocol reserves into a protocol-managed position that spans the full price range, ensuring continuity while enabling individual user participation on specific price ranges.

Concentrated liquidity allows users to choose where their tokens do "work". Wide ranges keep liquidity active across larger price ranges but typically collect fewer fees per unit of tokens. Narrow ranges collect higher fees per unit of tokens but stop collecting if prices move outside the specified range.

For example, providing liquidity from an ALPHA price of 0.5 TAO to 2.0 TAO covers a substantial price range. Providing liquidity from an ALPHA price of 0.95 TAO to 1.05 TAO concentrates the tokens in a tight range, potentially collecting higher fees if trading stays within.

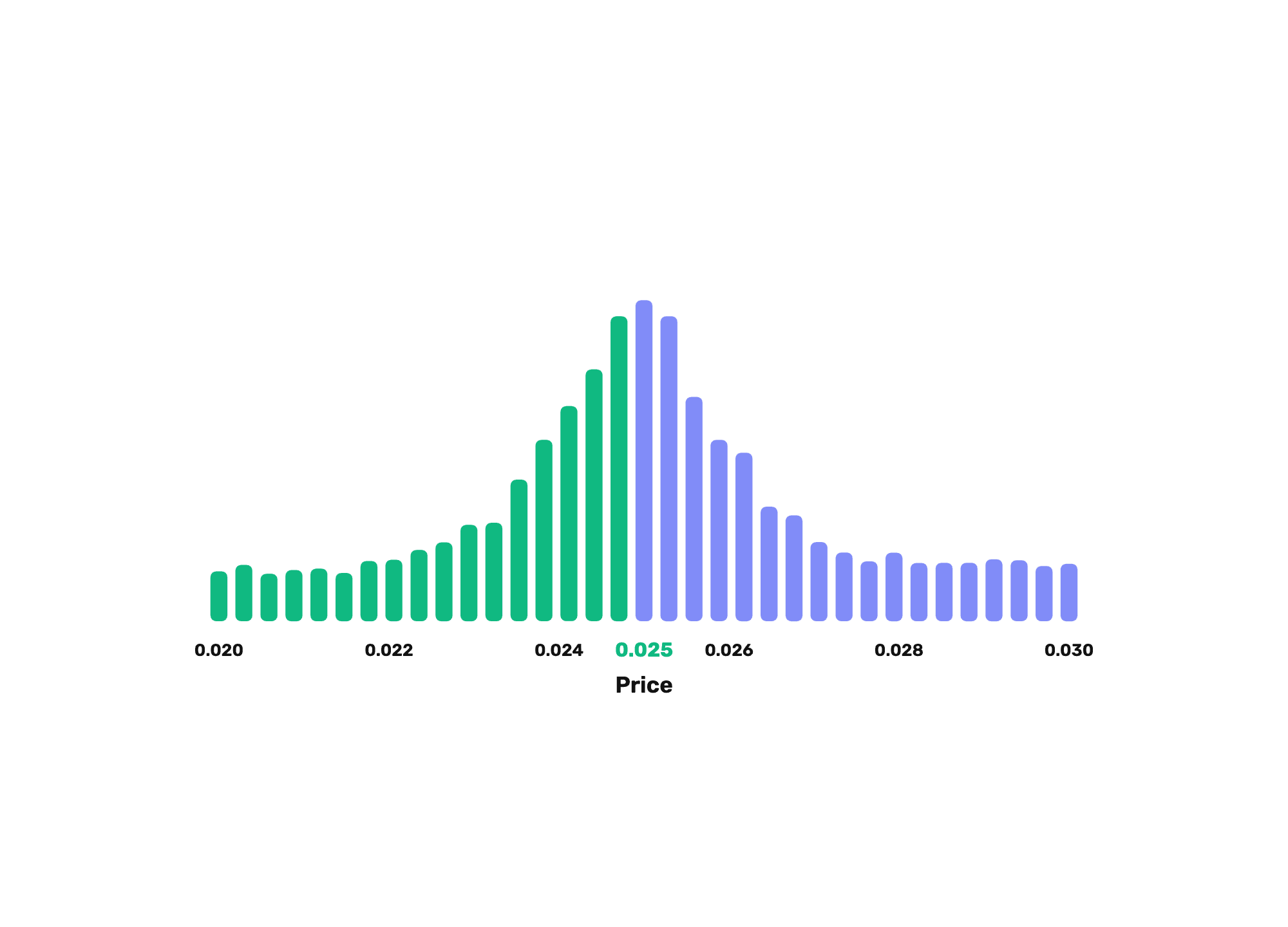

The protocol automatically determines the required token composition for the liquidity position based on the chosen range and current market price:

- Above current price: Only ALPHA tokens required

- Spanning current price: Both TAO and ALPHA tokens required

- Below current price: Only TAO tokens required

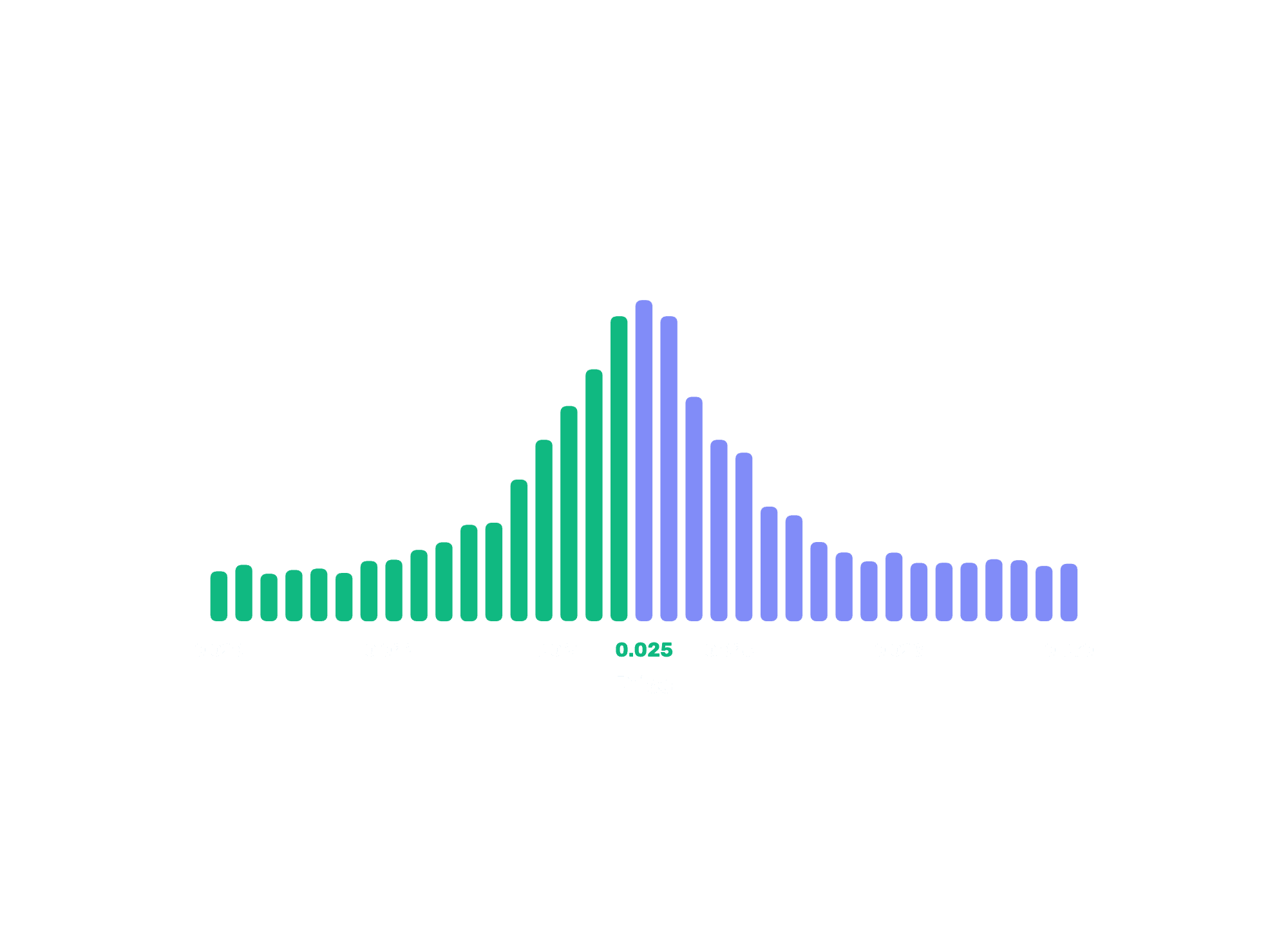

WHAT DOES THIS SHOW?

This graph is showing how liquidity positions will usually be provided in the current price range (price label in green). The liquidity provided below the current price only composed out of TAO tokens (green), while the liquidity provided above the current price is only composed out of ALPHA tokens.