Emissions

Newly created ALPHA tokens distributed to incentivize subnet participants and TAO emitted to subnets based on their net TAO inflow EMA. Emissions solve the fundamental problem of making the desired work financially profitable in a decentralized protocol like Bittensor.

Emissions are newly created tokens distributed every block (approximately every 12 seconds). In a decentralized protocol like Bittensor, participants must have a financial reason to contribute. Emissions provide those incentives to participants for the desired work.

Within each subnet, ALPHA emissions incentivize miners , validators , and subnet owners for doing the desired work. At the same time, TAO emissions get injected into subnet pools based on each subnet's net inflow EMA. Subnets with larger sustainable net inflows receive more TAO emissions, making them more attractive and attracting better participants.

Through these emissions, the blockchain makes it financially rational for it's participants to work honestly and for market participants to accurately assess what work is valuable.

REFERING TO SUBNET TOKENS AS ALPHA

Each subnet has its own token (ALPHA for subnet 1, BETA for subnet 2, etc.). For simplicity, we refer to all subnet tokens as "ALPHA".

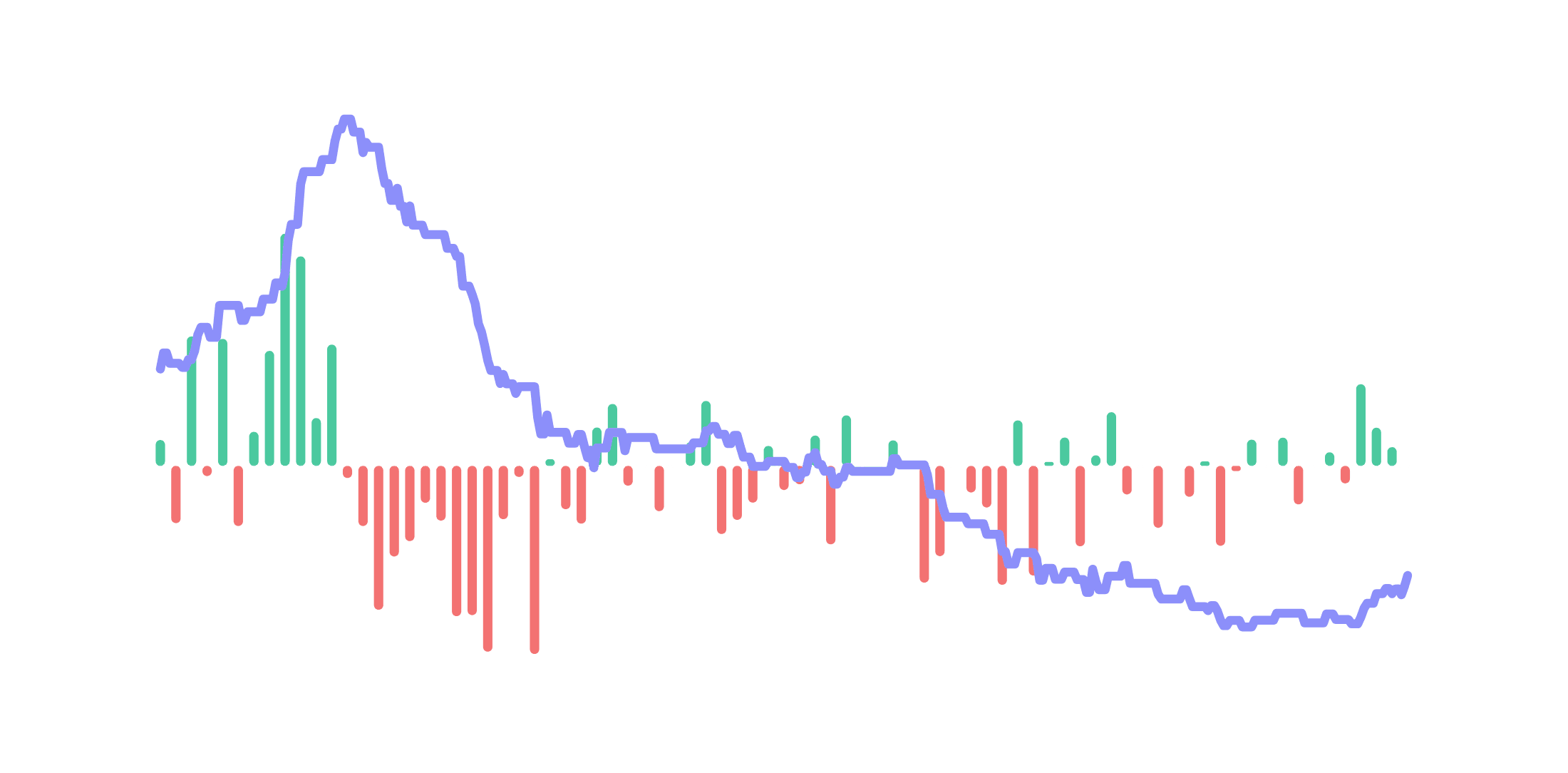

Each subnet receives a proportional share of the TAO emissions from each block based on its net inflow EMA. Subnets with larger net inflow EMAs compared to other subnets receive larger shares.

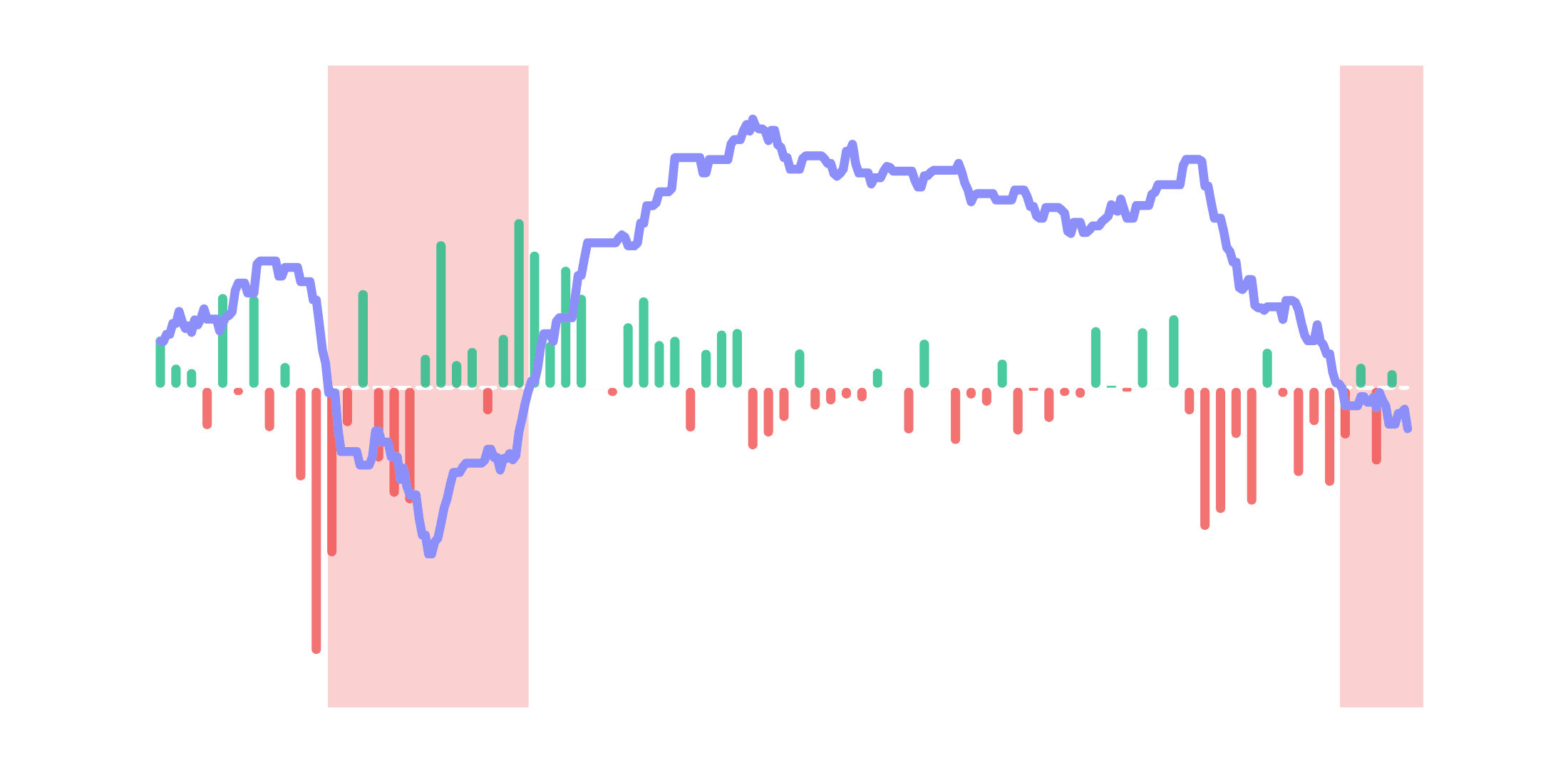

A net inflow represents the amount of TAO staked into the subnet minus TAO unstaked from it. At each block this net inflow is recorded, then smoothed out using an exponential moving average. This smoothing effect prevents temporary single-block volatility from disrupting the TAO emissions.

The formula for a subnet's share using this method is:

When a subnet experiences negative net TAO inflows (more unstaking than staking ) for a longer time, it receives no TAO emissions and ALPHA injections until the net inflow EMA becomes positive again.

EMISSIONS ON ROOT SUBNET

Subnet 0 (Root) is excluded from emissions and does not count toward the sum of subnet shares.

The net TAO inflow EMA is a calculated average of each subnet's net TAO inflow over time. It prevents single-block volatility from disrupting TAO emissions, creating stability by gradually adjusting to inflow changes rather than reacting instantly.

Every 12 seconds, each net inflow EMA gets updated by blending the current net inflow with the previous EMA. The smoothing is much stronger than the EMA price (approximately 87 days compared to 0.9 days), giving more weight to long-term inflow trends rather than temporary volatility. This means approximately 86.5% of the EMA is based on inflows from the most recent 86.8 days, while approximately 13.5% comes from older inflows (with a "look-back" that extends infinitely into the past).

Think of the "look-back" like a gradient, that becomes infinitely weaker the further into the past it goes, but never stops.

The TAO emission for each subnet gets injected into the subnet's pool. Based on the TAO emission and the current ALPHA price, a corresponding amount of ALPHA gets injected to keep the ALPHA price the same.

These injections act as liquidity for the subnet's pool and are not owned by anyone. When the ALPHA price significantly exceeds the subnet's TAO emission share, less ALPHA gets injected.

Should the ALPHA price fall below the TAO emission share, or the TAO emission increase significantly the subnet will become subsidized by the subsidy mechanism.

ALPHA emissions are distributed to subnet participants for their contributed work. Each subnet receives ALPHA emissions independently from its TAO emissions. The ALPHA emitted always equals the full block emission of ALPHA. This ensures that participants receive emissions regardless of whether TAO emissions are injected into the subnet's pool.

The distribution of ALPHA emissions follows these steps:

- 18% is being deducted for the subnet owner

- 41% goes to validators as dividends

- 0-41% go to root validators (based on the root proportion )

- The remaining ALPHA dividends go to the subnet validators

- 41% goes to miners as incentives